The very nature of FinTech companies entails that they hold ridiculous amounts of highly sensitive data.

And this is something that will only to grow in the future. Because of that, that their security need be on the highest level possible.

Now, if we take into account the sensitivity of data they hold in combination with the high risks of what can happen if they get stolen, it doesn’t come as a surprise that costs caused by cyber attacks are off the charts, either direct or indirect. But we’ll go over that in a bit.

FinTech companies are perfectly aware that they are prime targets for cyber attacks and are usually more secure than digital services in other industries.

But, check this out – 27% of the FinTech companies have still experienced a security incident and 29% are not sure if they had one since they have not checked!

This means that more than half these organizations (56%) have been breached or don’t care about it, so it’s no wonder that these attacks, or more precisely the costs that these attacks cause, have set a new industry trend on upping security measures.

Cyber Attacks Costs Rake Up Due to Domino Effect

You might want to sit down for this one.

According to the Microsoft and Frost & Sullivan Study, in an instance of a cyber attack, a large financial services company incurs an average of $7.9 million of economic losses, in direct and indirect losses as a consequence of the domino effect.

Customer disruption, remediation costs, fines from regulators and productivity loss all make direct losses which add up to about $1.8 million.

But, that’s only the beginning!

These attacks usually set off a chain of events leading to even bigger indirect losses and more serious long-term damage.

A cyber attack results in lower user trust, lower user trust results in dropping of share prices by 6% which then causes $6.1 million losses due to customer churn. Depressing!

Here’s another number and I promise I’m not trying to scare you, but a report by the IMF suggests that a potential average annual loss for banks caused by cyber attacks may be close to 9% of banks’ net income globally – around $100 billion!

In case of more severe cyber attacks, these costs are predicted to rise to $270 or even $350 billion. And that’s just the material costs – the long term effects of losses of this magnitude are hard to calculate, and imagine.

With cyber attacks on the rise, the digital transformation of financial services has significantly slowed down – as it should, until appropriate security measures are taken.

Still, since digital transformation can improve these companies’ profit margins, productivity, customer advocacy, and customer acquisition rates greatly, it’s all the more incentive to rethink our approaches to security implementation in FinTech apps.

Leveraging Cybersecurity to Gain an Edge Over Competitors

I must say that, right now, the majority of businesses take the wrong approach when implementing security into their apps. Instead of thinking about it during the design phase, it unfortunately often ends up being thought about sometime in the middle of the development process, or even worse, after the app has been completed.

On why this is the case I can only take guesses – it might be because the market is too competitive so everyone’s racing to release the next big technology or update first, but the one thing I know for sure is that you can easily afford to be behind the competitors, especially when you take into account the cost you will endure if your app suffers a cyber attack.

Users value security, especially when their sensitive data and hard earned money is at stake. And having in mind that more than three-quarters of users across Asia have experienced some type of online theft you can see why that’s the case.

To me, this is encouragement enough to take a bit more time to include proper security into new apps.

Security isn’t there to simply protect against cyber attacks, and in no way should it be an afterthought or something implemented in the midst of the production of the app.

In Asia Pacific, for example, a staggering 40% of FinTech businesses still look at security as a way to safeguard data, whereas only 25% see it as a feature that can be leveraged to gain an edge over competitors!

What I am saying is that when effective security is set up from the start of building a FinTech app, it allows for digital transformation to take place and sets the app for success.

When you have your security designed and thought out in the beginning, it’s easy to go about digitalization. You just develop your app & process. And, I know… “Just”, but imagine how much more complicated it would all be if you had to think about effective security measures that could work with your technology, and how to go about it all at the same time.

Without strategically thinking security through at the beginning of the development process, without making security the basis of the app, it’s like hiring a bodyguard at the entrance of your club after it had already been built with five windows that cannot be locked in the back.

Viewing Security and Privacy, But Also UX Equally the Best Way to Combat Rising Number of Cyber Attacks

Did you know that cybercrime is so widespread nowadays that it is actually considered an industry? And not just that, but it is considered one of the fastest-growing industries in the world!

McAfee’s global economic study, for example, found that at a minimum, $445 billion was lost in 2017 which is up around 30% from 2014, just three years earlier.

But it’s not just the amount of money loss that’s increased.

A Cybercrime costs report from Accenture and the Ponemon Institute states that the average number of breaches per financial services company has more than tripled since 2012. Back then it was 40, in 2017 it was 125 – just barely under the global average of 130 across all industries.

So, how do we go about cybersecurity in FinTech?

We think about the user trust we need in order for an app that handles financial transaction to gain traction.

Think of user trust as a plant. You have to water it constantly, and if it starts dying at some point, it will be extremely hard to nurture it back to health.

But, that’s not all – while security is vital, user experience shouldn’t be overlooked either.

It shouldn’t be forgotten that according to a PYMNTS study, an enormous 71% of financial services users prefer an authentication method for its ease of use.

People want it all.

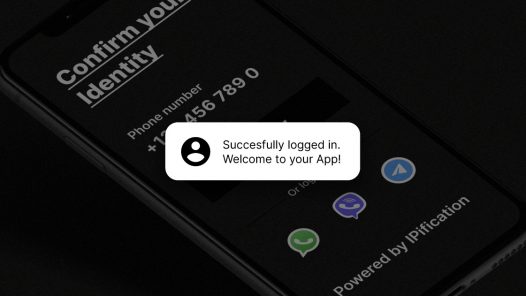

Your best bet would then be using mobile authentication solution that doesn’t compromise between these.