Having partnered with a plethora of mobile network operators around the world, as well as mobile app developers in the financial sector, each year, we make sure we check in with the newest reports that help us and our partners gain fresh perspectives and understanding of our market and improve our service accordingly.

This year, it seems that mobile network operators have more market opportunity in the digital identity and authentication market than even before. It’s up to the individual companies to take advantage of them, if they prepare accordingly and answer this market demand.

The good news is that they have a better starting position than any other vertical.

Let’s start by looking at the newest reports from the Mobile Ecosystem Forum:

1) Personal Data, Digital Identity, Verification and Authentication – Analysis and Opportunities

2) Enterprise Survey – Personal Data and Identity 2021: SMS OTP as a verification tool

Current State of Digital Identity Across Financial Sectors: The UX Paradox

The main categories digital identity solutions providers talk about are security and user experience. And what’s the priority for companies in the financial sector?

Security, of course. We already know this.

In fact, the primary driver of use of digital identity, verification and authentication in payments, banking, and fintech is security, 80, 72, and 58% respectively, while user experience (customer retention and conversion) never went above 12% in either of the sectors.

However, this isn’t to say that user experience isn’t important. If anything, it’s been continuously gaining importance over the last decade.

Seeing as user experience directly affects the companies’ bottom lines, and driven by customer expectations and complaints, this should come as no surprise. Did you know that globally, 60% companies attribute all, most and some churn to friction with identity verification, and authentication?

Offer someone a solution that could reduce their churn by 60%, and you could sell just about anything. It’s an incredible statistic, and it creates an amazing opportunity for mobile network operators.

MNO Opportunities: Higher Security Solutions, Frictionless User Experience & SIM Swap Detection

Mobile network operators have the best starting position to answer the above-mentioned market demand due to two reasons: 1) mobile is the most widely used platform, and 2) the majority of businesses and customers already rely on their identity solutions.

To start with, 63% use mobile only for identity verification and authentication globally. We’ve known that mobile was overtaking desktop for some time now, in all regards, but it’s great to get an official confirmation that the case is the same for digital, or should I say, mobile identity.

Furthermore, 93% of businesses use SMS OTP for some type of authentication and identity verification. They already turn to mobile network operators for these services, so it makes perfect sense that mobile network operators stay the providers of these services, but only if they properly react to the next statistic from this report.

78% of businesses have security concerns around SMS OTP user verification, and 64% express user experience concerns. And no wonder – new SMS OTP cyber attacks pop up every day, and we’ve always known that waiting around 10 seconds to verify your identity was far from an ideal user experience in 2022.

This is the first market opportunity that arises for mobile network operators. Because they already have a great tech infrastructure, and because it makes sense that they would be managers of mobile identities, they could greatly benefit from mobile IP address-based authentication and user verification solutions such as IPification.

IPification assigns each user with a unique mobile ID key based on device, phone number and IP address data, and verifies them within milliseconds with only one click. It’s bank-grade security with a seamless user experience.

To build on that, IPification is easy to implement as part of a multi-factor authentication system that’s becoming a necessity for companies worldwide. Currently, only 38% of businesses globally use MFA which makes for an additional great opportunity.

Finally, with the number of SIM swapping incidents growing worldwide, IPification SIM swap detection would come in very handy to expand on the MNO offering. As it currently stands, 60% of companies haven’t yet considered using SIM swap detection solutions which marks the third great market opportunity that telcos could take advantage of.

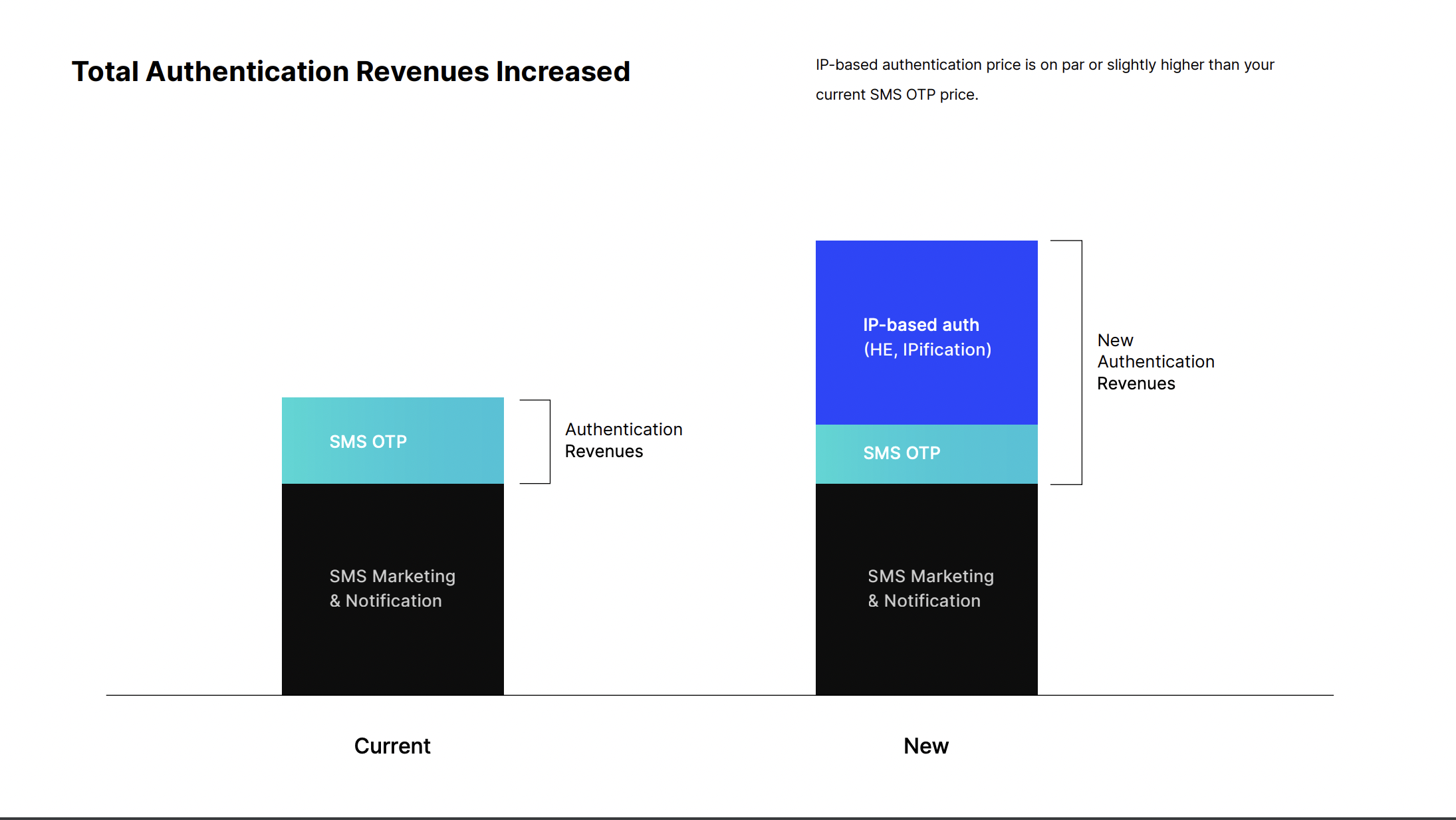

Here, it’s important to note that adding a solution like IPification would not mean the cannibalization of a telco’s SMS OTP revenue. In fact, IPification would work in conjunction with this solution, and because its price is on par or slightly higher than the current SMS OTP price, the revenue would significantly increase.

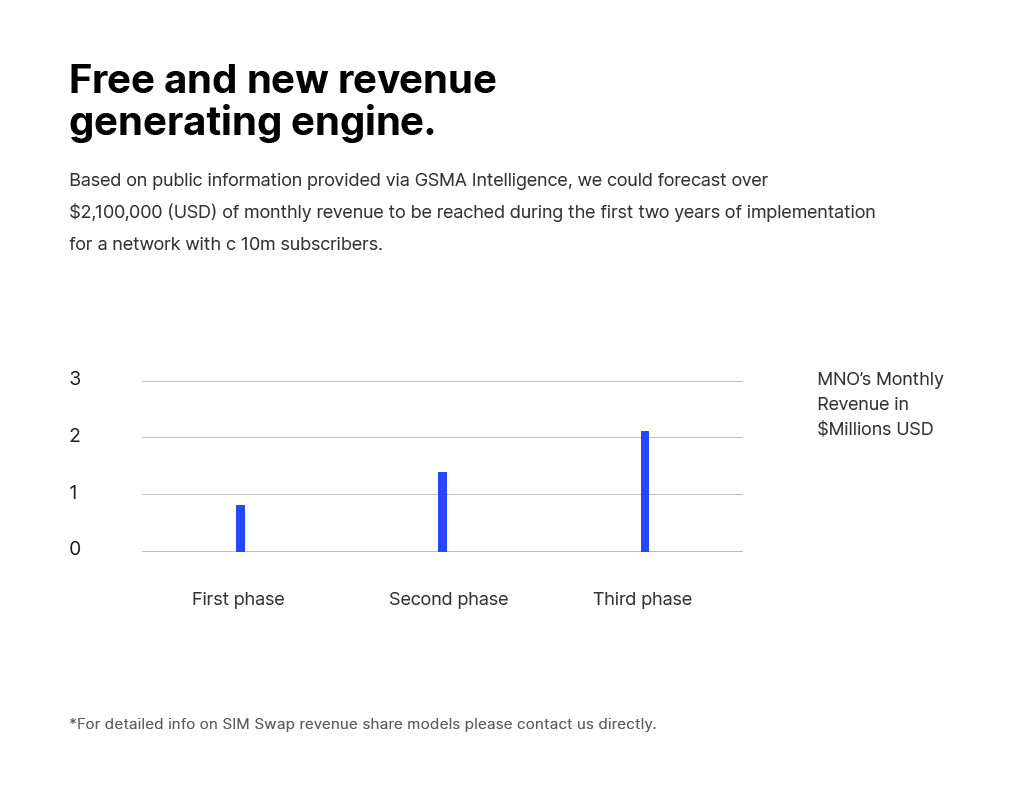

If you’re one for concrete numbers, we have used public information provided by GSMA Intelligence to forecast $2,100,000 USD of monthly revenue to be reached during the first two years of implementation for a telco with around 10M subscribers.

That being said, the specific estimate will depend on the country and the telco, but it should be within the 30% range of the estimate in the graph.

Whether or not telcos succeed in taking the biggest share of this market will depend on their agility and speed of adoption of effective identity solutions, whether IPification or something else. But one thing’s for sure: the time to act is now.

We can help! IPification is ready to be implemented within days, and we’re ready to share any additional information and projections that you may be interested in. Just shoot us an email!